Announcement

Collapse

No announcement yet.

Announcement

Collapse

No announcement yet.

2K24: New York Mets

Collapse

X

-

I’m not sure Mets fans were the issue. The /r WallStreetBeats community, or some on the periphery were giving him grief about his hedge fund backing the funds that were overshorting stocks like $GME.

Originally posted by Hornsby View Post2021 Auction Anatomy

2021 Keeper Decisions

2020 Auction Anatomy

2020 Pre-Auction

2015 Auction Anatomy

2014 Auction Anatomy

2011 Auction Anatomy

RotoJunkie Posts: 4,314

RotoJunkie Join Date: Jun 2001

Location: U.S.A.

Comment

-

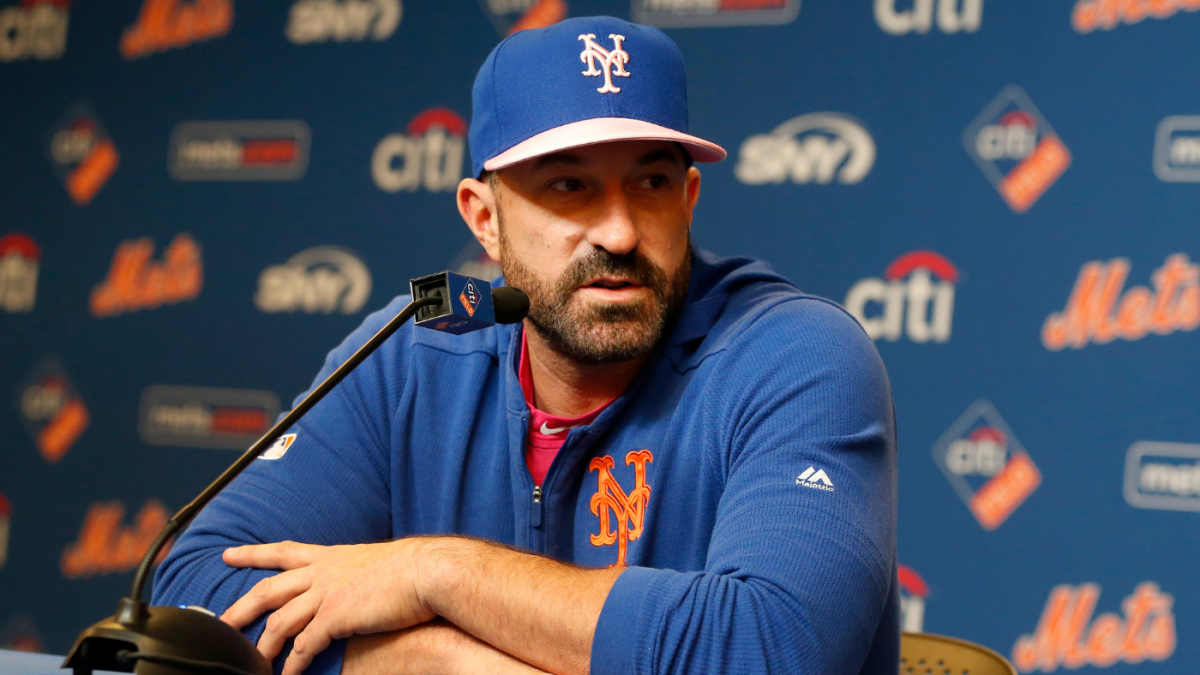

Former Mets manager and current Angels pitching coach Mickey Callaway has been accused by at least five different women in sports media of lewd and inappropriate behavior, according to Brittany Ghiroli and Katie Strang of The Athletic. The allegations stretch back to Callaway's time as pitching coach for the Indians and also include his time with the Mets and Angels.

Ghiroli and Strang write:

"Mickey Callaway, the former New York Mets manager and current pitching coach for the Los Angeles Angels, aggressively pursued at least five women who work in sports media, sending three of them inappropriate photographs and asking one of them to send nude photos in return. He sent them unsolicited electronic messages and regularly commented on their appearance in a manner that made them uncomfortable. In one instance, he thrust his crotch near the face of a reporter as she interviewed him. In another, he told one of the women that if she got drunk with him he'd share information about the Mets."

Comment

-

Seth Lugo to get elbow surgery: https://sports.yahoo.com/mets-seth-l...143849449.html

Rumors that Lugo has a new pair of tattoos with one on his right arm saying "Operate here" and one on his left arm saying "DO NOT OPERATE HERE" have yet to be confirmed.I'm just here for the baseball.

Comment

-

It’s fun to make fun of...but the Mets got a better financial benefit than Bonilla received. I generally lament stupid things the Mets do...but that wasn’t one of them. #TimeValueofMoneyOriginally posted by Hornsby View Post2021 Auction Anatomy

2021 Keeper Decisions

2020 Auction Anatomy

2020 Pre-Auction

2015 Auction Anatomy

2014 Auction Anatomy

2011 Auction Anatomy

RotoJunkie Posts: 4,314

RotoJunkie Join Date: Jun 2001

Location: U.S.A.

Comment

-

Oh, it's always going to be fun to make fun of...can't stop, won't stop.Originally posted by ThatRogue View PostIt’s fun to make fun of...but the Mets got a better financial benefit than Bonilla received. I generally lament stupid things the Mets do...but that wasn’t one of them. #TimeValueofMoney "Never interrupt your enemy when he is making a mistake."

"Never interrupt your enemy when he is making a mistake."

- Napoleon Bonaparte (1769-1821)

"Your shitty future continues to offend me."

-Warren Ellis

Comment

-

Yeah, now that Tebow has retired, Bobby Bonilla is all that we have left.Originally posted by Hornsby View PostOh, it's always going to be fun to make fun of...can't stop, won't stop.

“Two things are infinite: the universe and human stupidity; and I'm not sure about the universe.”

“Two things are infinite: the universe and human stupidity; and I'm not sure about the universe.”

― Albert Einstein

Comment

-

-

He got a guaranteed 8% interest rate, compounded, I believe. At the time his payments started, the then present value of his $5.9 million from 2001 (they started in 2011) was $12.9 million given the time the payments were spread out. He will get paid $29.8 million total. He absolutely took the Mets to the woodshed, whether or not interest rates spike between now and then because he has almost already gotten more than the value of his contract based on the time value of money and still has more than half the payments outstanding.Originally posted by ThatRogue View PostIt’s fun to make fun of...but the Mets got a better financial benefit than Bonilla received. I generally lament stupid things the Mets do...but that wasn’t one of them. #TimeValueofMoney

Comment

-

That was a terrible article, and it was embarrassing to see it written on CNBC. If the value of the original $5.9 million contract grew to $12.9 million by 2011, then using historical market rates of return (9.8% per year for the S&P 500), the value of the $12.9 million by 2036 would be ~$134 million. If Bonilla invests every dollar of the $1.19 million payment each year, at the same rate of return, it would grow to ~$114 million. That’s a $20 million difference.Originally posted by cavebird View PostHe got a guaranteed 8% interest rate, compounded, I believe. At the time his payments started, the then present value of his $5.9 million from 2001 (they started in 2011) was $12.9 million given the time the payments were spread out. He will get paid $29.8 million total. He absolutely took the Mets to the woodshed, whether or not interest rates spike between now and then because he has almost already gotten more than the value of his contract based on the time value of money and still has more than half the payments outstanding.

https://www.cnbc.com/2020/07/01/bobb...lucrative.html

Based on what we know today, the results look even worse. The actual S&P 500 return from 2011 - 2020 averaged 13.9% annually. That $12.9 million value in 2011 would be worth $43.7 million today. Investing every dollar of the $1.19 million annual payment would get you to only $22.9 million today. That’s a $20+ million gap already...and it will only widen over the next 15 years (unless something goes terribly wrong with the economy and the market).Last edited by ThatRogue; 02-20-2021, 12:39 AM.2021 Auction Anatomy

2021 Keeper Decisions

2020 Auction Anatomy

2020 Pre-Auction

2015 Auction Anatomy

2014 Auction Anatomy

2011 Auction Anatomy

RotoJunkie Posts: 4,314

RotoJunkie Join Date: Jun 2001

Location: U.S.A.

Comment

-

You are not pricing any risk into the equation. That is a poor way to handle things. If one could invest with a guaranteed rate of return of 8% and no risk whatsoever, one would accept that instantly and it would be a great deal given historical and expected interest rates. Your arguments in both this situation and the Tatis situation seem to assume risk doesn't exist or should not/cannot be priced into the equation. I don't think that's a particularly good way to judge financial matters.Originally posted by ThatRogue View PostThat was a terrible article, and it was embarrassing to see it written on CNBC. If the value of the original $5.9 million contract grew to $12.9 million by 2011, then using historical market rates of return (9.8% per year for the S&P 500), the value of the $12.9 million by 2036 would be ~$134 million. If Bonilla invests every dollar of the $1.19 million payment each year, at the same rate of return, it would grow to ~$114 million. That’s a $20 million difference.

Based on what we know today, the results look even worse. The actual S&P 500 return from 2011 - 2020 averaged 13.9% annually. That $12.9 million value in 2011 would be worth $43.7 million today. Investing every dollar of the $1.19 million annual payment would get you to only $22.9 million today. That’s a $20+ million gap already...and it will only widen over the next 15 years (unless something goes terribly wrong with the economy and the market).

Comment

-

I understand risk...but there's a reason the teams are willing to offer the terms they do. Achieving more aggressive goals often means taking on some reasonably calculated risk and not simply doing what is "safe". (The Parable of the Talents: Matthew 25:14-30)Originally posted by cavebird View PostYou are not pricing any risk into the equation. That is a poor way to handle things. If one could invest with a guaranteed rate of return of 8% and no risk whatsoever, one would accept that instantly and it would be a great deal given historical and expected interest rates. Your arguments in both this situation and the Tatis situation seem to assume risk doesn't exist or should not/cannot be priced into the equation. I don't think that's a particularly good way to judge financial matters.

The last 35 years (1985-2020) have included the rise and collapse of the tech bubble, the 9/11 attacks, the Great Recession, and COVID-19. During that time, the S&P 500 index is up 4,853.32%, which is an annual return of 11.45%. If I run the analysis for a 35 year period ending at either of the significant stock market collapses of 1929 and 2008, the overall annual returns still exceed 8% per year. When considering a long-term (35 year) investment arrangement such as the one Bonilla entered into, overall stock market risk tends to be lower than what many people think.

So, for a relatively young man (25-35), I wouldn't invest the majority of my money at a guaranteed rate of 8% that had no chance of upside over the long-term...nor would I advise any young person to do so IF they wanted the opportunity to optimize the way they grow their financial portfolio. Would I suggest they put a portion of their money in such a vehicle...of course (although locking in a guaranteed rate for such a long-time also carries interest rate fluctuation/inflation risk...remember, CD rates in the mid-eighties were in the 9 - 11% range). But I wouldn't suggest locking it all up in an annuity to be proportioned out in relatively small amounts each year. Of course, in Bonilla's case, perhaps he had other investments and this was simply part of his diversification strategy. But, my original comments were concerning the ridicule many people (and even the foolish CNBC article) heap upon the team for making a deal with financial terms that clearly benefited them when you look at the numbers (and isn't that what we, as roto players, do?).2021 Auction Anatomy

2021 Keeper Decisions

2020 Auction Anatomy

2020 Pre-Auction

2015 Auction Anatomy

2014 Auction Anatomy

2011 Auction Anatomy

RotoJunkie Posts: 4,314

RotoJunkie Join Date: Jun 2001

Location: U.S.A.

Comment

Comment